In this feature, I’ll explore for you how to create a valuable legacy when selling your business and get paid three times! When I share the key principles that improve the selling price of your business, what business owners love is a set of actions they can start implementing to improve the value of their business right now and the increased choices and value this creates for them.

Who can benefit:

∙ Those business owners and or partners that have already built a successful business and are planning an exit in the future – the timing and reason will be specific to you and your personal circumstances.

∙ Ambitious business owners that want to build a profitable business that enables them to step away and spend time on other things once its finished. You might want more personal time and holidays with your family, or you might want to invest in another interesting business ideas.

∙ Anyone in business! If selling your business is not yet on your radar yet, don’t worry you’ve the opportunity to in place things that some only wished that had done earlier!

Read: A powerful success secret

For example, in a family business, the creators’ ideal might be to pass the business onto his children to keep the legacy going. Perhaps it is too early in the day to determine if this fits with his/her Children’s plans. Rather than take no action, until this is clear as some might – focusing on what will create value now in the form of profits and time opens more choices both now and in the future.

– Starting to put in place the foundations to enable the business to thrive without the owner present – in the short term frees up time – time that can be enjoyed with young children (trust me you don’t get that back!).

– Growing the business’ profitability, fuels further growth and spending on your lifestyle now, maybe a home or a holiday, the choice is yours.

– If the children turn out not to be interested in the business, you’ll have far more value and choices within the business at this point. If you decide to sell you can realise a greater value that can be used to support, you and your family in any way you choose.

Getting paid three times!

So how does that work?

It’s simple really getting paid once is the salary you take from your company; twice is the dividends from profits you take out to spend or invest personally. As we all know as you increase the amount of profit you make the more you can choose to take or invest.

Getting paid a third time is value you can realise when you sell your business. It still amazes me the number of people who neglect this opportunity and leave money on the table!

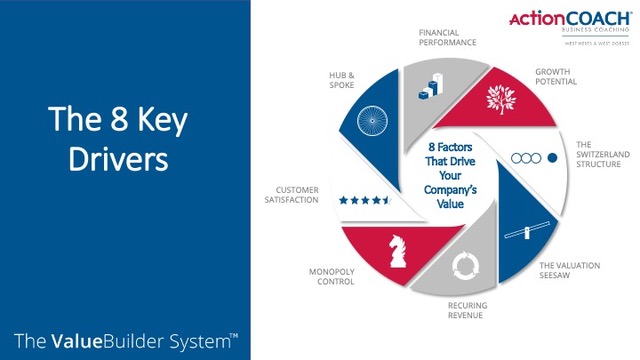

8 WAYS TO BUILD THE VALUE OF YOUR COMPANY

We use The Value Builder System, to improve the value of our client’s businesses so that you can gain freedom over your time and money and get back to the reasons you started business in the first place.

Value Builder have worked with more than 50,000 businesses since 2012 and have discovered that there are eight key drivers to your company’s value:

1. Financial Performance.

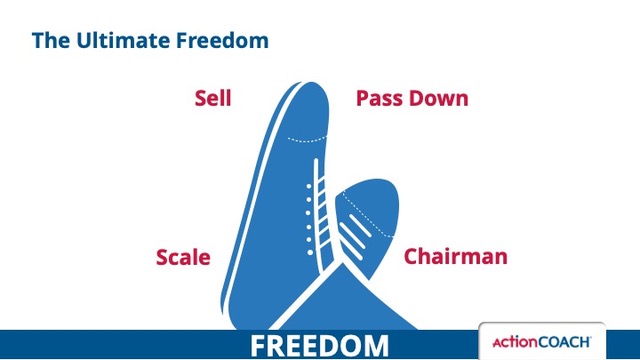

Remember, the goal is to build a sellable business – not necessarily because you want to sell it… but because owning a sellable business gives you the ultimate freedom.

Financials obvious of course, the key to note here is that financial buyers buy into one key thing when they make an acquisition: your future stream of profits.

Therefore, as an owner, you have two big levers to pull on to drive up the value of your company:

– How much profit your company will make in the future?

– How reliable are your estimates?

Let’s look at how an acquirer will value your business one day:

The acquirer will start by trying to estimate how much profit you’ll make in the future and then apply a rate of return they want in return for committing their capital. For example, imagine you have a business that is forecasting to earn £1,000,000 in pre-tax profit

next year and a buyer wants a 15% return on their money. He/she would be willing to spend £869,570 today, for the rights to £1,000,000 a year from now. Simply take £1,000,000 and divide it by 15% or 1.15.

2. Growth Potential.

The second factor that drives your company’s value is your potential to scale up and grow in the future.

Many factors will come into play here – to support your focus however what’s important is a select set of products or services that are:

∙ Teachable

∙ Valuable

∙ Repeatable

3. Eggs not all in one basket!

The next factor in creating a valuable business is called The Switzerland Structure. The name comes from the country which is obsessed by remaining independent.

You too should be obsessed by making sure your business is independent of any one customer, employee, or supplier.

Ask yourself If you lost your largest customer what would happen to your business?

Ideally, you should be able to switch any of your suppliers without significantly impacting your business overall.

4. The Valuation Seesaw

It’s named after the Seesaw because just like the child’s playground toy, the value of your business moves in the opposite direction of your cash flow needs. In other words, the more cash your business needs, the less it’s worth. The opposite is also true: if your business generates cash as you grow, your business will be worth more to a buyer.

The reason is simple: when a buyer acquires your business, they must write two cheques (bank transfers): one to you, the owner and a second check to your

business to funds its “working capital” (The money you need in the bank to pay your immediate obligations like salaries rent and payables).

The money all comes from the same pocket so the bigger the cheque the acquirer needs to write for working capital, the smaller the check you’ll end up getting.

Not only does improving your cash flow increase the value of your company, it also makes it a lot less stressful to run.

Bonus Tip: Read The Value of Time

5. Recurring revenue.

To reiterate point 1 – Financial Performance, a buyer buys your future stream of

profit and therefore, the more reliable you can make your business model the more valuable your company. That’s why subscription models are so popular these days.

What percentage of your sales/revenue is “recurring”, meaning you will have this revenue again next year without having to generate new demand through advertising or marketing?

There are many types of recurring revenue some more attractive to others from a buying perspective. I don’t cover them all in this blog, but if I’ve sparked your interest and you want to learn more, get in touch. I will say that the most valuable form of recurring revenue is a multi-year contract where the customer is legally obliged to buy from you in the future.

6. Monopoly Control.

Companies with a monopoly on what they do get significantly higher offers.

Your goal should be to find an attribute or benefit of your product that makes it unique in the market which will give you more control over its pricing which in turn gives you higher margins which gives you more money for marketing allowing you to further

differentiation your offering starting a virtuous cycle.

How differentiated/unique is your product or service?

7. Customer Satisfaction.

Not surprisingly, having satisfied customers is an important element of growing a valuable business. Don’t stop at just satisfied – your goal should be to have customers who are not only happy but also willing to re-purchase and refer you to their friends.

That is a much higher bar to reach – yet it’s one winning business focus on.

Do you know your NPS? (Net Promoter Score)

For anyone less familiar your NPS score in its most basic form is the response to one question. Considering your complete experience with our company, how likely would you be to recommend us to a friend or colleague? (There is then a standard way to calculate scores which acts as an industry standard)

8. Hub & Spoke.

The final driver of value is arguably the most important. We call it “Hub & Spoke” and it is the extent to which your business relies on you personally.

The name comes from the airline industry’s reliance on “hub” airports which is an efficient was to move planes around the globe until a hub gets “snowed in” which is when the entire system breaks down.

Likewise, a Hub & Spoke owner controls their business with all decisions centralized at the hub. Remove the hub and the business is worthless which is why companies reliant on their owner are either deeply discounted or in some cases worthless.

More importantly, Hub & Spoke businesses are stressful to run because you can never take a break and all decisions – even the most mundane is brought to you!

This phenomenon is called “The Owner’s Trap”. Signs you’ve fallen into the trap are:

– business slows when you take a vacation

– customers come to you with problems

– your growth has reached a plateau

Most owners started their business for the freedom to build something on their terms.

Many business owners fall short of this dream and become trapped in their business. The goal of any business owner seeking freedom should be to build a valuable, sellable business because that gives you the best set of choices.

Your business is usually much richer than you think – there are plenty of hidden opportunities that will bring in extra profits. If you’d like to explore these or are already thinking about selling your business, let’s have a more in-depth Business meeting.

Find out how much your company is currently worth click here to receive your complimentary Value Builder score and we can follow up to discuss how to improve your performance on each factor.

I hope this blog makes you think and more importantly prompts you take positive action for you and your business. If you need help in selling your business, or you want to grow your business, then give us a call at 01442 773310 or email westherts@actioncoach.co.uk